- ESG stands for Environmental, Social, and Governance. ESG stock investment ratings are relatively new. ESG ratings help investors identify and understand financially material ESG risks to a business.

- With more investors using ESG scores for stock selection, the consequences of a bad rating can be significant. A poorly ESG rated stock may be considered an ‘unsustainable asset’ by investors. It can impact its stock price significantly.

|

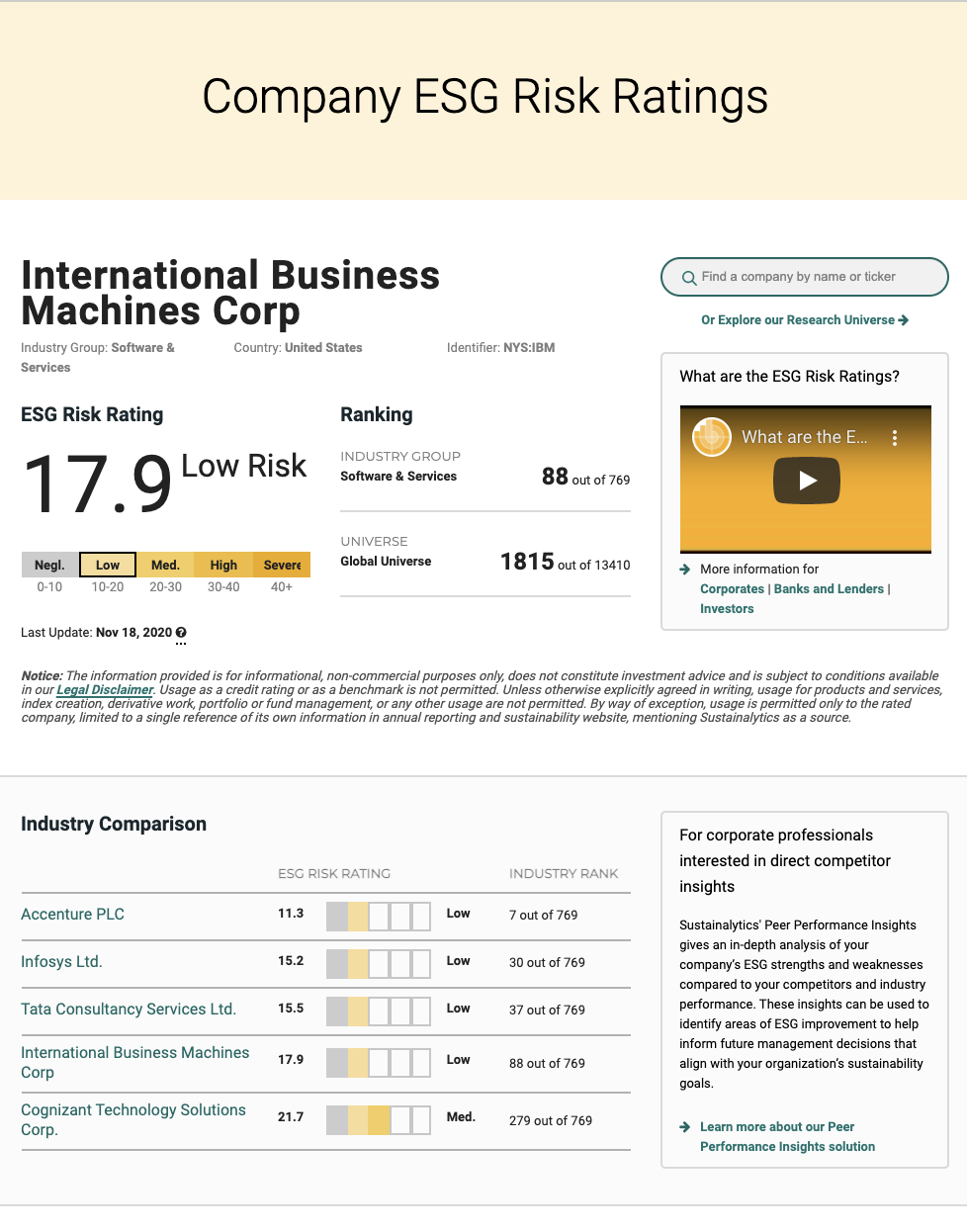

Sustainalytics offers data on 40,000 companies worldwide and ratings on 20,000 companies and in 172 countries.

The security-level ESG Risk Ratings are a well-known benchmark among institutional asset managers, pension funds, and other financial market participants integrating ESG factors into their investment processes and decision-making. Sustainalytics’ ESG Risk Ratings offer clear insights into the ESG risks of publicly traded companies. Its online company ESG risk rating tool is easy to use even more ESG investing rating details should be disclosed. |

|

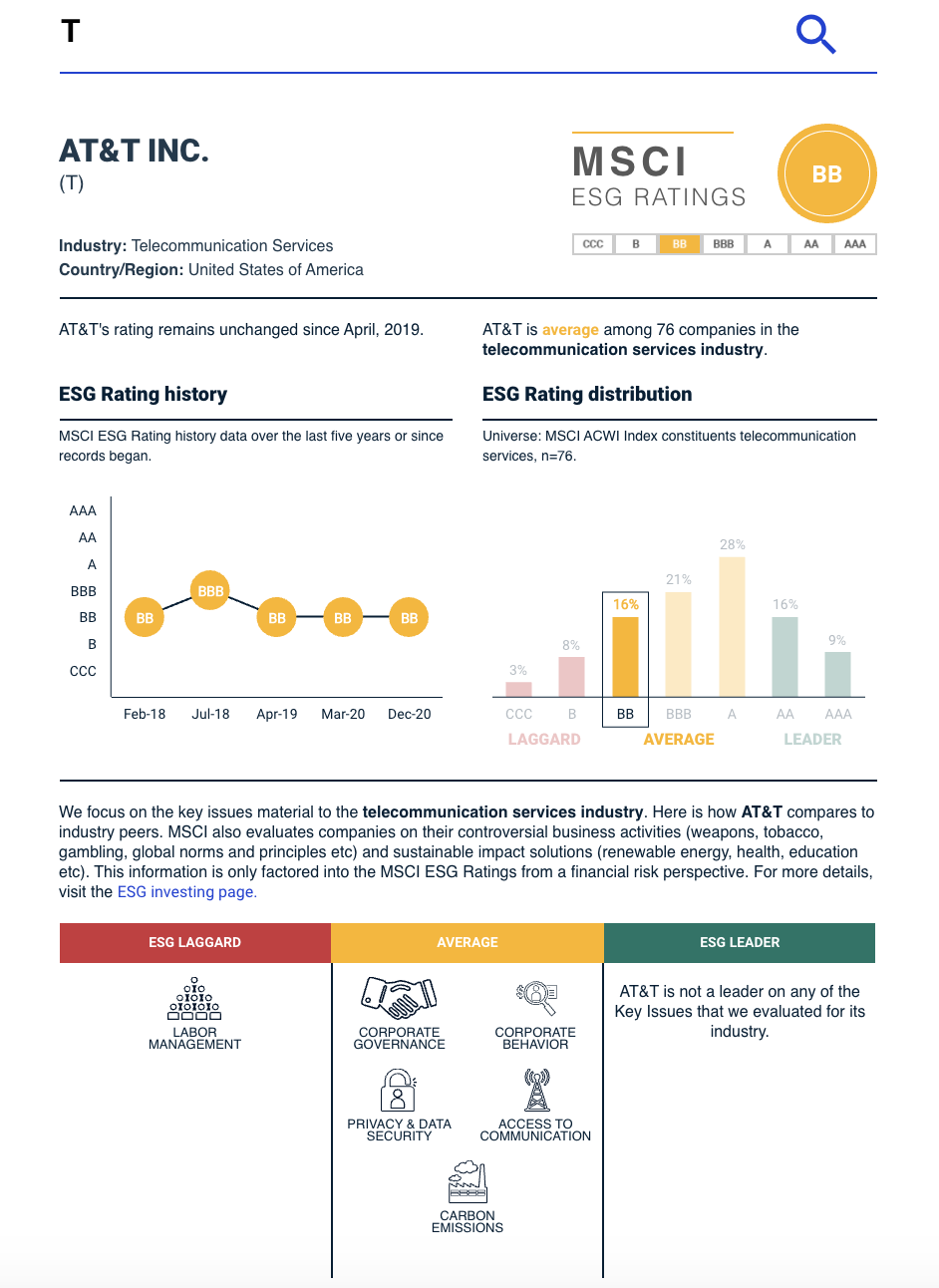

An MSCI ESG Rating measures a company’s resilience to long-term, industry material environmental, social, and governance (ESG) risks.

ESG risks and opportunities can vary by industry and company. MSCI ESG rating model identifies the ESG risks. It uses a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers. MSCI's online ESG Ratings corporate search tool allows investors to search over 2,800 companies; constituents of the MSCI ACWI Index. |