- Hybrid stock investment ratings refer to those ratings combining fundamental and technical research to arrive at an overall rating.

- Most hybrid ratings are updated more frequently than fundamental ratings. These ratings can provide a better overall stock evaluation to assist investors in their buy or sell decisions.

|

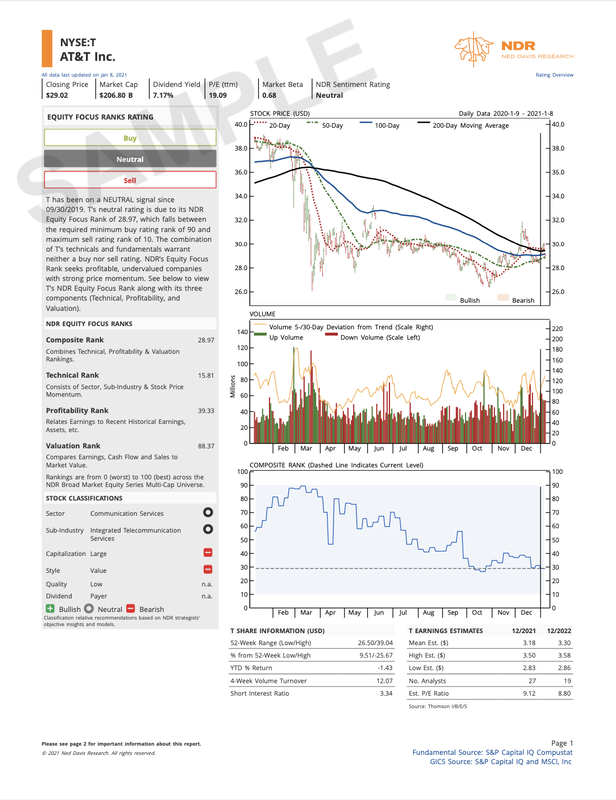

Ned Davis Research approach combines both fundamental and technical research disciplines. Truly insightful and timely ideas demand a balance between these two disciplines.

NDR uses the weight of the evidence and a comprehensive approach to come up with market insights. By processing millions of data series to fuel a historical perspective, the research builds proprietary indicators and models to calm investors so they can see the signals and avoid mistakes. Ned Davis Research Report is available at many leading brokerage firms free of charge for their clients. |

|

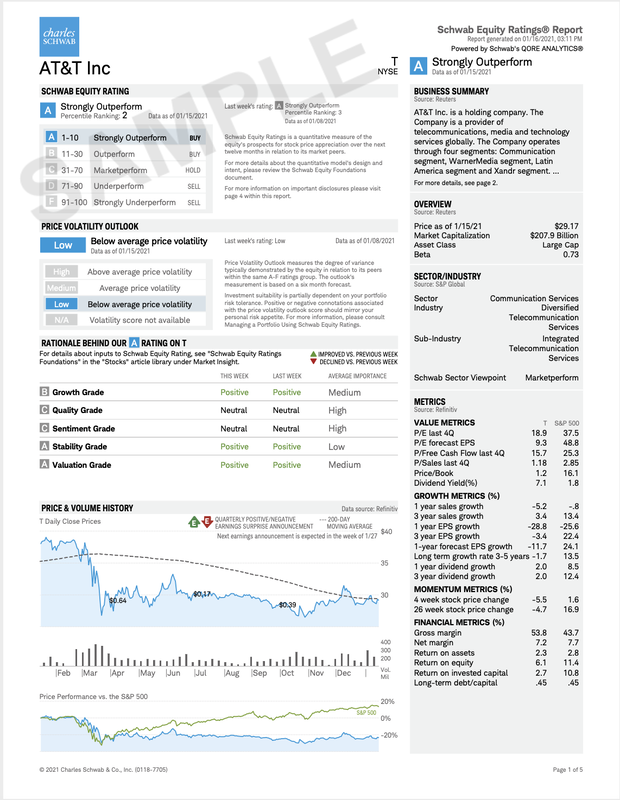

Schwab Equity Ratings uses a disciplined, systematic approach that evaluates each stock based on a wide variety of investment criteria from five broad categories: Growth, Quality, Sentiment, Stability, and Valuation.

This approach attempts to gauge investor expectations since stock prices tend to move in the same direction as changes in investor expectations. Stocks with low and potentially improving investor expectations tend to receive the best Schwab Equity Ratings, while stocks with high and potentially falling investor expectations tend to receive the worst Schwab Equity Ratings. Schwab Equity Ratings is available free of charge for Charles Schwab clients. |

|

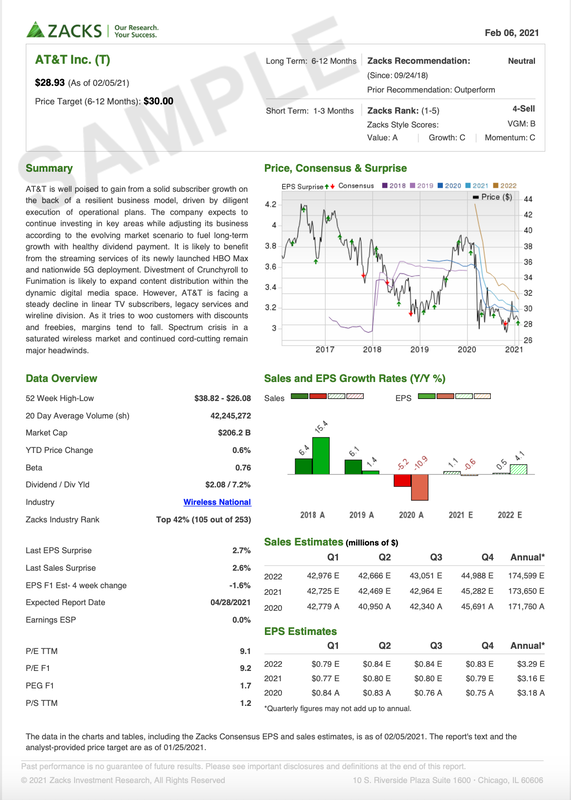

Zacks Equity Research is professional-grade research that combines quantitative models with insight provided by its equity analysts.

At the center of everything, Zacks commits to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to creating its proven Zacks Rank stock-rating system. Zacks Equity Research Report is available at many leading brokerage firms free of charge for their clients. |