- Equity research firms offer fundamental stock ratings after extensive research of the public financial statements of a company. Analysts may also talk to executives and customers or listen in on the quarterly earnings conference calls.

- Most analysts issue fundamental ratings four times a year. Research analysts issue ratings often accompanied by a target price to helps investors understand a stock’s fair price compared to its market value.

|

CFRA offers more than 12,000 quantitative and 1,500 qualitative reports on 5,000+ U.S. and global corporations.

For decades, CFRA has provided investors with independent and actionable investment news to help them accomplish their personal finance goals through investing. CFRA helps investors get to the bottom of the multitude of choices out there, providing fundamental analysis and ratings to determine the best investments for your goals and strategy. CFRA Stock Report is available at many leading brokerage firms free of charge for their clients. |

|

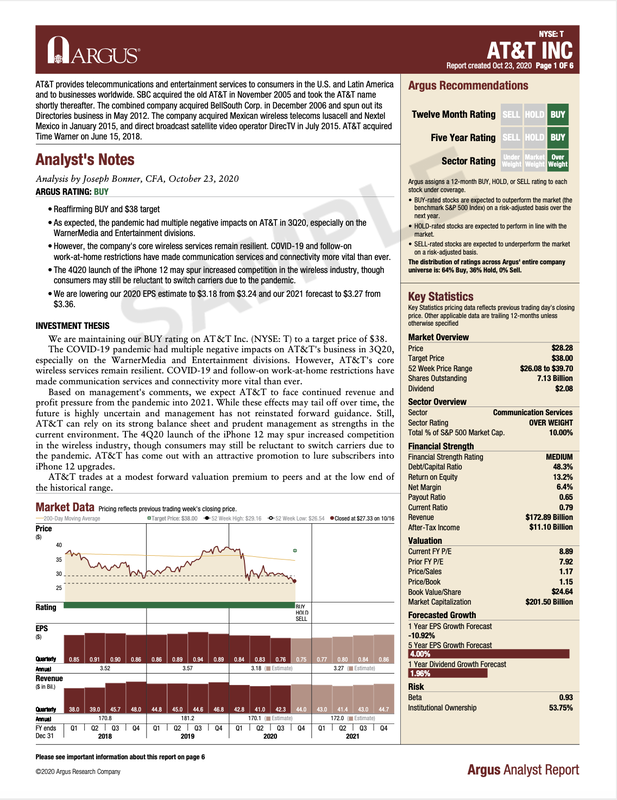

Argus Research is an independent research firm producing high-quality investment and economic research.

Argus Research independently makes critical judgments about companies through its recommendation on a stock, BUY, HOLD, or SELL. These ratings reflect the judgment of an analyst about a company’s prospects as an investment in terms of value, expected growth, and risks. Argus Analyst Report is available at many leading brokerage firms free of charge for their clients. |

|

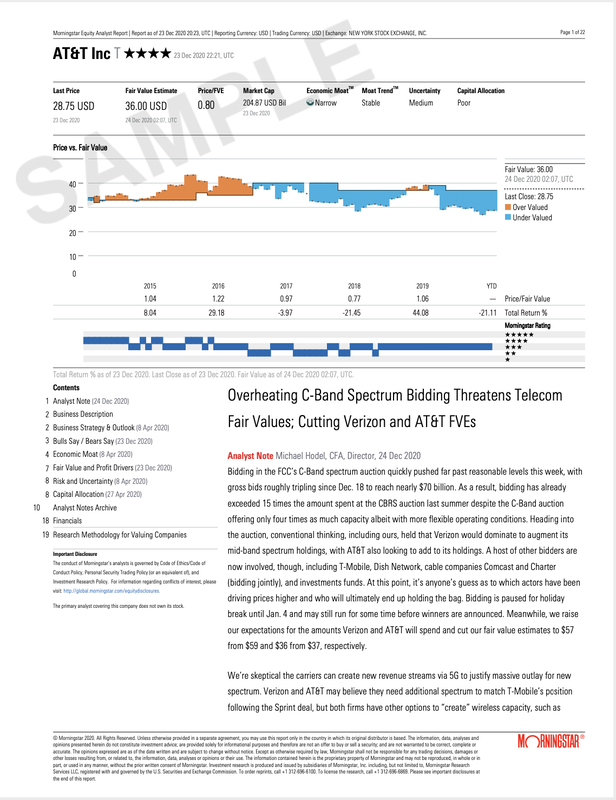

The Morningstar Rating for stocks can help investors uncover undervalued stocks, cutting through the market noise.

The ratings apply a stock's current price and the estimate of the stock's fair value. The bigger the discount, the higher the star rating. When looking for investments, a 5-star stock is generally a better opportunity than a 1-star stock. Morningstar Equity Analyst Report is available at many leading brokerage firms free of charge for their clients. |